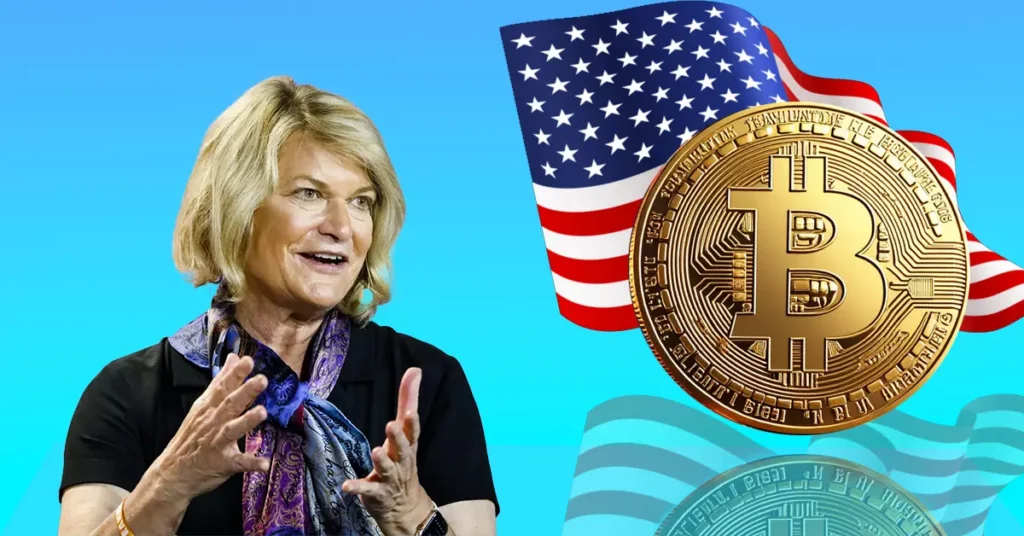

Cynthia Lummis Pushes For Strategic Bitcoin Reserve

In a groundbreaking move, Senator Cynthia Lummis has come out in support of establishing a Strategic Bitcoin Reserve for the United States. The Wyoming Senator has long been a proponent of the cryptocurrency space and believes that incorporating Bitcoin into America’s financial arsenal could have far-reaching benefits for the nation.

According to sources close to the matter, Senator Lummis is working with David Sacks, a prominent venture capitalist known as the “Crypto Czar,” to push through legislation that would allow the U.S. Treasury Department to manage Bitcoin alongside traditional reserve assets like gold and the dollar. This proposal has sparked significant interest in the cryptocurrency community and among investors.

The plan involves utilizing around 200,000 Bitcoins, which are currently seized in criminal cases and worth approximately $20 billion. Rather than auctioning these off, they would be placed into a strategic reserve to help stabilize national finances. To ensure transparency, regular audits and robust security measures would be implemented by the Treasury Department.

If this plan comes to fruition, it could have significant implications for the U.S. economy. The establishment of such a reserve could potentially curb inflationary pressures, strengthen the dollar, and even grant the nation greater negotiating power in international economic negotiations with countries like China and Russia.

While there are legal hurdles and market volatility that must be navigated before this plan can become a reality, Senator Lummis’s efforts have sent shockwaves throughout the cryptocurrency space. The move could potentially pave the way for more mainstream acceptance of Bitcoin as an asset class and increase investor confidence in the technology.

The proposed initiative is not without its challenges, but Senator Lummis remains committed to pushing this agenda forward. As the situation develops, it will be crucial to monitor the progress of this plan and assess its potential impact on global financial markets.

Source: coinpedia.org