Grayscale Bitcoin Mini Trust Surpasses $1 Billion in Net Inflows

The Grayscale Bitcoin Mini Trust has exceeded $1 billion in net inflows for the year 2024, according to a recent report from the company. This milestone highlights the growing demand for low-cost cryptocurrency investment options and underscores the competitive nature of the market.

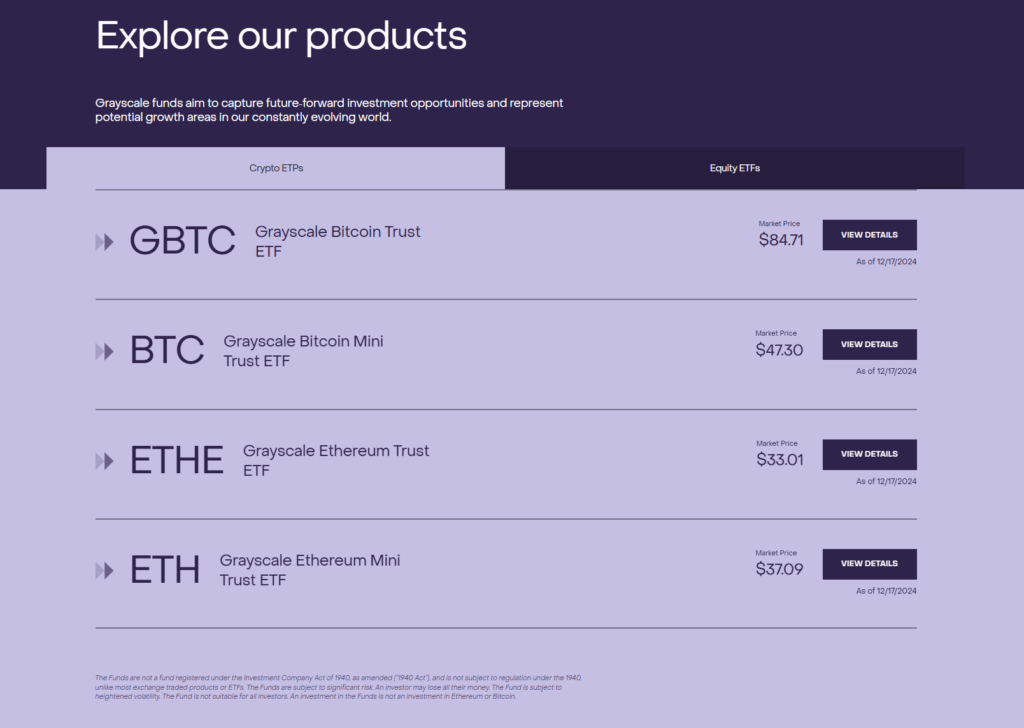

In July, Grayscale introduced the Bitcoin Mini Trust and Ethereum Mini Trust as alternative products to its higher-cost offerings, such as the Grayscale Bitcoin Trust (GBTC) and Ethereum Trust (ETHE). The Grayscale Bitcoin Mini Trust charges a management fee of 0.15%, significantly lower than the 1.5% and 2.5% fees for GBTC and ETHE, respectively.

The move is aimed at providing investors with accessible exchange-traded products (ETPs), catering to those seeking affordable cryptocurrency ETFs. John Hoffman, Grayscale’s managing director, emphasized in October that the success of low-cost funds like BTC and ETH reflects a growing demand for easily accessible exchange-traded products (ETPs).

The launch of spot Bitcoin ETFs earlier in 2024 has triggered significant activity in the crypto investment space. U.S.-based Bitcoin ETFs collectively crossed $100 billion in assets by November, as reported by Bloomberg Intelligence.

Source: coinchapter.com