Title: Grayscale Bitcoin Mini Trust Surpasses $1 Billion in Net Inflows

Grayscale’s Bitcoin Mini Trust has surpassed the remarkable milestone of $1 billion in net inflows for 2024, according to a recent report. This significant achievement highlights the growing demand for low-cost cryptocurrency investment options among investors.

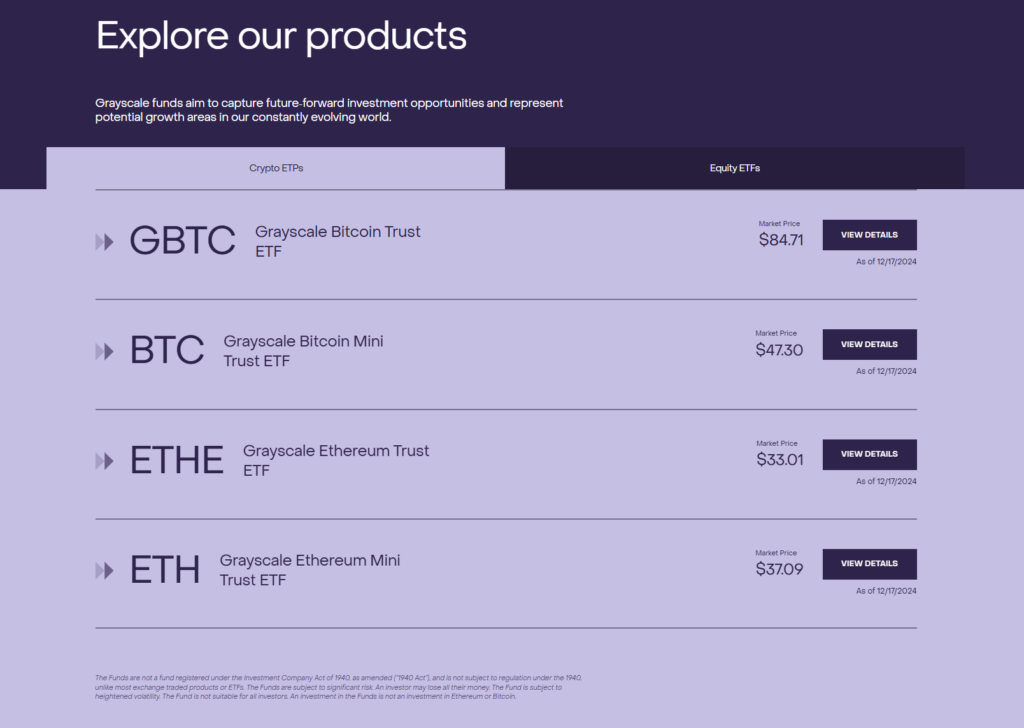

The introduction of the Bitcoin Mini Trust and Ethereum Mini Trust in July marked Grayscale’s effort to cater to this rising interest in affordable exchange-traded products (ETPs). The Bitcoin Mini Trust, in particular, boasts a management fee of 0.15%, a substantial reduction from the 1.5% and 2.5% fees associated with Grayscale’s higher-cost offerings such as GBTC and ETHE.

In an October statement, John Hoffman, Grayscale’s managing director, acknowledged that the success of these low-cost funds reflects an increased appetite for accessible exchange-traded products. This growing demand is likely fueled by a desire among investors to diversify their portfolios without incurring excessive fees.

Recent events have further solidified this trend, as the launch of spot Bitcoin ETFs earlier in 2024 triggered significant activity in the crypto investment space. As a result, U.S.-based Bitcoin ETFs collectively surpassed $100 billion in assets by November, according to Bloomberg Intelligence.

In response to this competitive market, several ETF providers have reduced their fees to attract investors. For instance, VanEck extended its fee waiver for its HODL Bitcoin ETF (HODL) in November. Industry benchmarks indicate that the typical fee for cryptocurrency ETFs ranges between 0.15% and 0.25%, with Grayscale’s Mini Trusts positioned at the lower end of this spectrum.

Beyond Bitcoin ETFs, Grayscale has expanded its offerings to include investment funds focused on alternative cryptocurrencies. In October, the company launched a fund dedicated to Aave’s governance token, while in August, it introduced funds for tokens like Sky, Bittensor, and Sui.

In anticipation of a crypto-friendly regulatory environment, several issuers are preparing to introduce new cryptocurrency ETFs. With President-elect Donald Trump set to take office in January 2025, efforts to secure SEC approval for additional crypto funds have intensified. Trump has hinted at plans to position the U.S. as a global leader in cryptocurrency.

In this context, regulators may seize the opportunity to lead the industry forward, paving the way for further developments in the cryptocurrency ETF market.

Source: coinchapter.com