Nexo’s ETF Proposal Blends Bitcoin Growth with Carbon Sustainability

In a groundbreaking move, fintech company Nexo and 7RCC Global have jointly submitted an S-1 amendment to the U.S. Securities and Exchange Commission (SEC) for their innovative Credit Futures ETF proposal. This pioneering initiative combines the growth potential of Bitcoin with financial instruments focused on environmental sustainability.

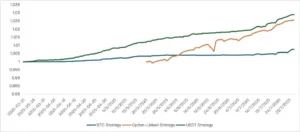

The proposed structure allocates 80% of its portfolio to Bitcoin, a leading digital asset renowned for its decentralized nature and high liquidity. The remaining 20% is dedicated to Carbon Credit Futures, which are tied to the predicted value of carbon credits. These credits are commonly used in cap-and-trade systems to manage emissions in regions such as the European Union, California, and the Regional Greenhouse Gas Initiative.

This unique approach ensures adaptability to regulatory changes while fostering sustainable investment practices. The integration of carbon credit futures with Bitcoin provides investors with a diversified portfolio that aligns their financial goals with environmental responsibility.

The ETF’s submission comes amid significant growth in the cryptocurrency market, which has seen $36 billion in net inflows since January. If approved, Nexo’s ESG-focused ETF will directly compete with industry leaders like BlackRock and Fidelity, offering investors an option that combines financial returns with environmental stewardship.

Kalin Metodiev, Co-founder and Managing Partner at Nexo, emphasized the long-term vision behind this initiative. He stated, “Today’s generation seeks not only to profit but to make a difference.” This ETF represents a significant step toward integrating cryptocurrency investment with sustainable finance, setting a new benchmark for responsible investment solutions.

The collaboration between Nexo and 7RCC Global aligns with global climate initiatives, including the World Economic Forum’s Safeguarding the Planet program.

Source: crypto-economy.com