Markets Show Resilience Ahead of End-of-Year Options Expirations: Bybit x Block Scholes Crypto Derivatives Report

As the year draws to a close, the cryptocurrency market has surprisingly exhibited resilience in the face of massive options expirations. This phenomenon has been observed by Bybit, the world’s second-largest cryptocurrency exchange by trading volume, in collaboration with Block Scholes.

The latest Crypto Derivatives Analytics Report from Bybit and Block Scholes highlights an unusual market behavior ahead of end-of-year options expirations. Typically, such events would trigger increased volatility, but this time, the markets seem to be defying expectations.

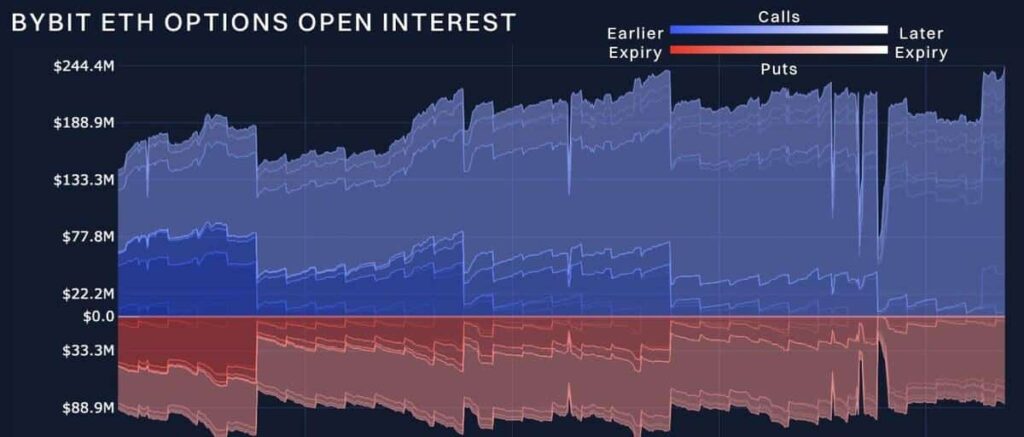

Data shows that Bitcoin (BTC) and Ethereum’s (ETH) realized volatility has indeed increased, however, short-term options have not adjusted accordingly. This suggests that while spot prices are fluctuating, the options market is not fully reacting to these shifts. Notably, BTC and ETH volumes display distinct patterns in this regard, with BTC exhibiting less sensitivity to changes in spot prices.

The report indicates that over $525 million worth of BTC and ETH options contracts are set to expire on December 27th, making it one of the largest end-of-year expirations to date. Despite these massive expiring contracts, expectations for volatility have remained subdued.

Source: www.crypto-news.net