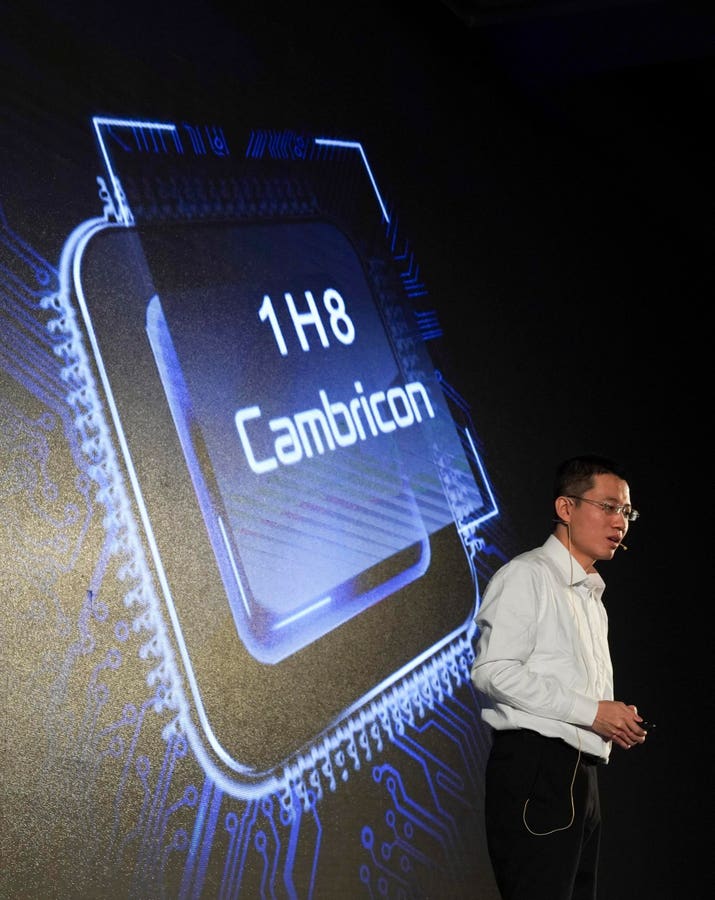

AI Mogul Chen Tianshi Amasses $10 Billion Fortune As Shares Soar 500%

Forbes Asia Premium

In a stunning turn of events, Cambricon Technologies’ founder and chairman, Chen Tianshi, has seen his net worth skyrocket to an astonishing $10 billion after the company’s Shanghai-listed shares surged an unprecedented 500% in 2024. The remarkable growth is fueled by China’s push for technology self-reliance amidst escalating tensions with the US.

Chen, a child prodigy who began his research career at the state-affiliated Chinese Academy of Sciences at just 24 years old, launched Cambricon Technologies in 2016 while still working at the institute. The company has since become one of the few publicly traded AI chip developers in China, with investors flocking to the stock amid growing optimism over its prospects.

Despite some analysts questioning whether Chen’s company can sustain such an extraordinary rise in value, many believe Cambricon Technologies is poised for long-term success due to Beijing’s aggressive push to localize AI technology. Industry insiders point out that market shares held by domestic companies in China’s AI chip market will continue to rise as the government encourages the use of local technologies.

The company’s rapid growth has also sparked concern over a perceived bubble in the Chinese tech sector, with some experts warning that the valuations of Cambricon Technologies and other AI chip developers are unsustainable. Dickie Wong, an executive director at Kingston Securities, notes that the company’s price-to-sales ratio is currently over 340 times, significantly higher than Nvidia’s 30 times. This has led some investors to wonder if Chen’s $10 billion net worth is a flash in the pan.

However, others believe that Cambricon Technologies’ customized AI chips may hold an edge in the Chinese market due to their adaptability for specific uses and applications. The company boasts that its products have been used by AI startups Baichuan AI and HiDream.ai to develop AI models, as well as by undisclosed local internet companies for computer vision and language processing.

While some industry experts predict a decline or consolidation of smaller players in the market, Cambricon Technologies remains optimistic about its 2024 sales growth, expecting an increase of up to 69.2% year-on-year to 1.2 billion yuan. The company also forecasts a significant reduction in losses, shrinking up to 53.3% to 396 million yuan.

Despite the controversy surrounding its valuation, Chen’s net worth has undoubtedly made him one of the wealthiest individuals in the Chinese tech sector. As the global AI market continues to evolve and shift, only time will tell if Cambricon Technologies can maintain its remarkable run of success or whether it is a short-lived phenomenon.

Source: www.forbes.com