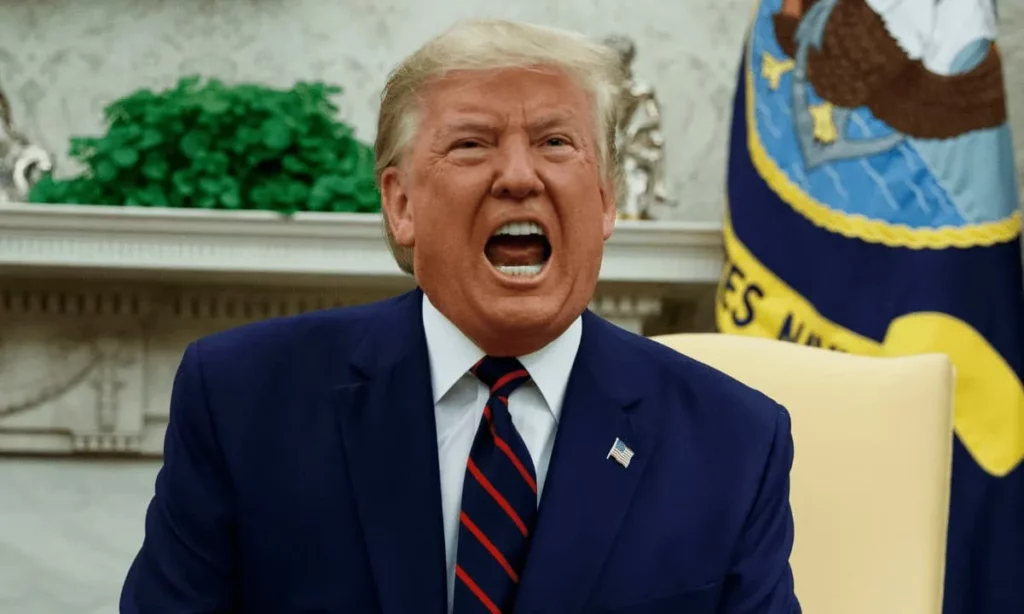

Trump Meme Coins Face Scrutiny After Rapid Launch Before Inauguration

The sudden and unprecedented launch of Donald Trump’s meme coin, TRUMP, has raised significant concerns about its legality, tax implications, and political repercussions. The rapid growth in value and market capitalization within a short span of 24 hours has sparked widespread debate, particularly among financial experts.

In a tweet, Coinage founder Zack Guzmán highlighted the strategic significance behind this hasty launch. He emphasized that waiting even one day could have exposed Trump to potential Constitutional violations and impeachment (again). This sudden move is seen as an attempt to circumvent these concerns and avoid direct accusations of profiting from the presidency.

The legal classification of TRUMP has sparked intense scrutiny, with many questioning whether it meets the criteria for a security. The Securities and Exchange Commission (SEC) uses the Howey Test to determine if an asset qualifies as a security. Although Trump’s team has claimed that TRUMP is not a security, the ambiguity surrounding meme coins poses a significant challenge.

Additionally, tax compliance issues have emerged as another major concern. The Internal Revenue Service (IRS) taxes cryptocurrency profits, and with Trump’s team holding 80% of the meme coin, which will be unlocked over three years, questions arise regarding whether this unlocking process constitutes a taxable event. Moreover, capital gains taxes would apply when assets are sold or traded, making timing, cost basis calculations, and detailed record-keeping crucial for compliance.

The potential use of TRUMP to circumvent political donation transparency and contribution limits by the Federal Election Commission (FEC) has also raised concerns. The risk of disrupting US political finance norms and potentially provoking allegations of corruption is substantial.

As a result, the meme coin’s value fluctuations will have significant implications on tax filings, with the potential to harm Trump’s political reputation in case of a drastic drop in value.

The sudden rise of TRUMP has sparked an intense debate within the financial and regulatory communities.

Source: cryptopotato.com