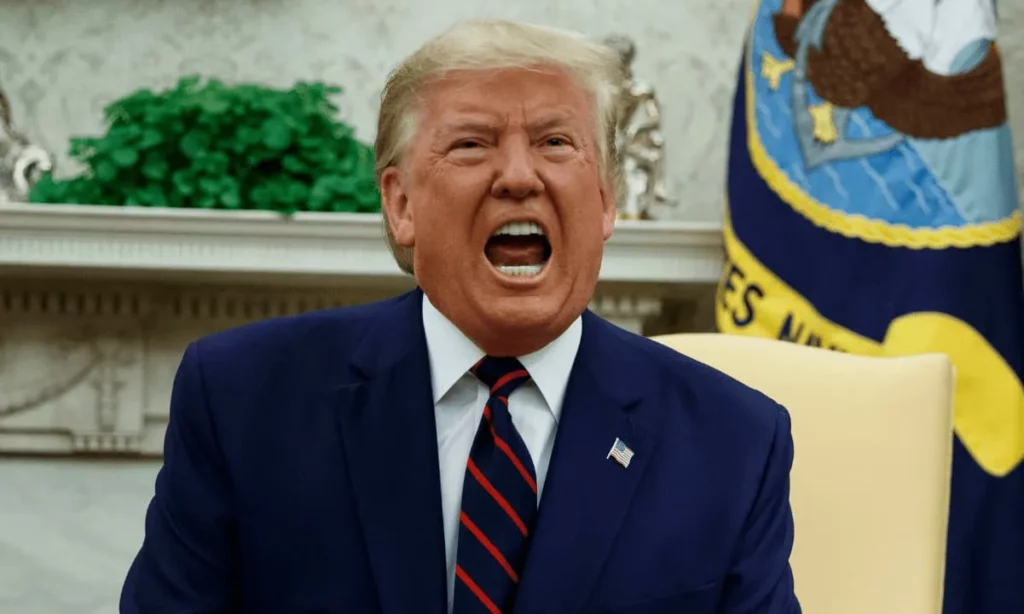

Will Trump’s ‘Short-Term Pain’ Plan Result in Long-Term Gains for Crypto?

The recent market downturn is not just a coincidence; it’s part of the plan. United States President Donald Trump has set his sights on intentionally crashing markets to address several economic issues, and the impact will be far-reaching. The question on everyone’s mind now is whether this “short-term pain” strategy will ultimately result in long-term gains for the crypto market.

Trump’s Plan

The President appears to be willing to take a short-term hit to achieve his objectives. He wants interest rates to decrease, which would undoubtedly cause some short-term pain. This approach could lead to significant market volatility across all asset classes, including cryptocurrencies. It remains unclear whether investors will be prepared for this downturn or not.

As traditional markets experience downturns, investors may reduce their exposure to high-risk assets like crypto in order to cover losses elsewhere or shift to cash positions. Market instability could also result in liquidity issues within crypto markets, potentially causing exaggerated price movements. In the short term, it is likely that the market will follow stock market trends.

On the other hand, lowering interest rates could ultimately benefit crypto as an alternative investment when cheap money searches for yields. Economic uncertainty may also accelerate efforts to regulate the sector, which could provide clarity and attract more institutional adoption in the long run.

Dollar strength weakening recently means that cryptocurrencies could potentially benefit as alternatives to fiat currencies over time.

Source: https://cryptopotato.com/will-trumps-short-term-pain-plan-result-in-long-term-gains-for-crypto/