Trump’s Tariffs Hit Hard Bitcoin (BTC), Solana (SOL), and Ethereum (ETH)

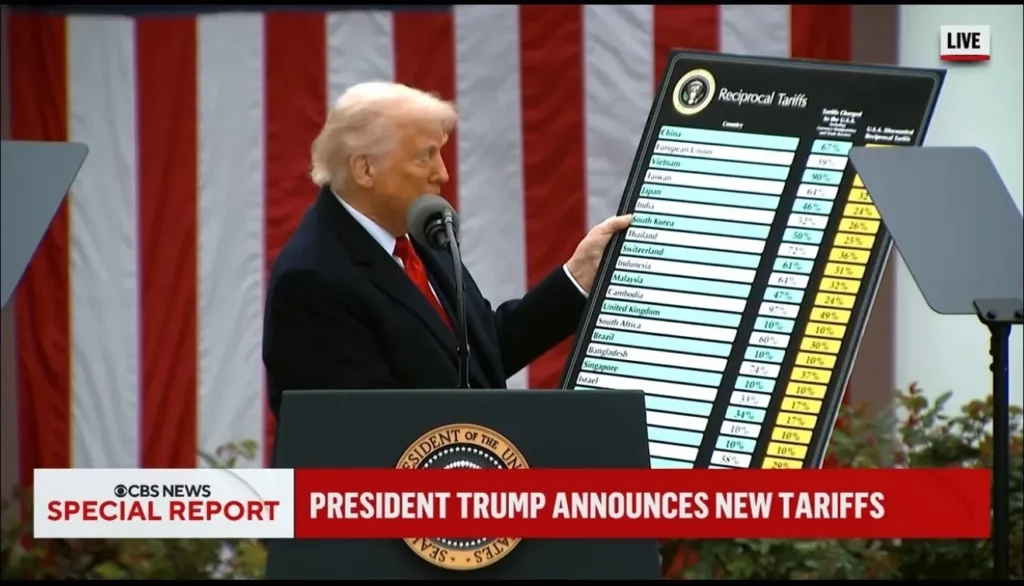

On April 3, 2025, the global financial markets were sent into a tailspin following President Donald Trump’s announcement of new tariffs on nearly 200 of America’s trading partners. The swift response from the markets resulted in a sharp decline across various asset classes, with cryptocurrencies not being spared.

Bitcoin, which had previously reached $88,000, took a significant hit, dropping by 3% to settle at $82,600. This steep decline was accompanied by a 3.6% fall in the overall crypto market, as reflected by the GMCI 30 index.

The impact on altcoins was even more pronounced, with Ethereum plummeting by over 6% to below $1,800, Solana experiencing a staggering 6.5% drop to nearly $118, and a Trump-backed memecoin falling by over 12%, dipping below $10. Among the top cryptocurrencies, XRP suffered losses ranging from 2% to 6.2%.

The broader market reaction was equally disheartening, with futures linked to the S&P 500, Nasdaq, and Dow Jones plummeting between 2% and 4%. Big tech giants like Apple, Nvidia, and Amazon also felt the brunt of this economic upheaval, with their shares dropping 7%, 6%, and 6% respectively, as reported by CNBC.

The crypto mining sector was particularly hard hit, with Bitcoin miners facing significant headwinds due to increased costs associated with specialized ASIC chips from China. This could lead to reduced profits for many mining operations. However, some U.S.-based mining companies that source their equipment from non-Chinese suppliers may be less affected by these tariffs.

In the face of this uncertainty, investors are left reeling as they try to make sense of the sudden and drastic changes in global trade policy.

Source: https://bitcoinik.com/trumps-tariffs-hit-hard-bitcoin-btc-solana-sol-and-ethereum-eth/