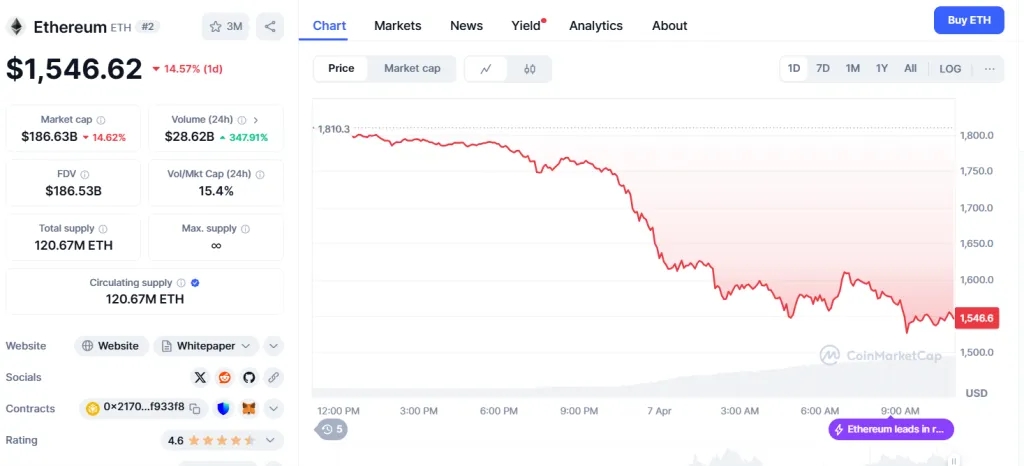

Ethereum (ETH) has been hit with a significant blow as it plunged below the critical $1,600 mark following a sharp 15% dip. The sudden downturn has triggered widespread panic among investors, largely driven by renewed macroeconomic concerns. Fresh trade tensions sparked by aggressive tariff announcements from President Donald Trump, coupled with unforeseen geopolitical developments, have shaken both traditional and crypto markets alike.

The recent price action has left many wondering what’s next for the ETH price. As it stands, Ethereum is approaching a crucial support zone that had previously held strong between $1,520 to $1,540. This level was significant in early and late 2023 and is now under intense pressure. If ETH fails to hold above this zone, the next major downside target would be around $1,400.

The situation took an even darker turn after ETH breached the $1,870 to $1,880 range, a key Fibonacci level that had previously provided support. This breach signaled a bearish trend, with analysts predicting a move towards the $1,520–$1,540 region, which is now unfolding as expected. The RSI has entered oversold territory, indicating potential for a short-term bounce, although it doesn’t guarantee a market bottom. In fact, in March, ETH experienced a brief recovery before facing further declines.

In line with the market’s downturn, an Ethereum whale faced a staggering $106 million liquidation on Maker over the weekend, involving 67,570 ETH. As $ETH plummeted, the 67,570 $ETH ($106M) held by this whale on #Maker was liquidated! https://t.co/kXSkKh1H0P pic.twitter.com/IDjzbQ8P3z

— Lookonchain (@lookonchain) April 7, 2025

Source: https://coinpedia.org/news/ethereum-price-prediction-today-will-eth-fall-below-1400-after-128m-liquidation/