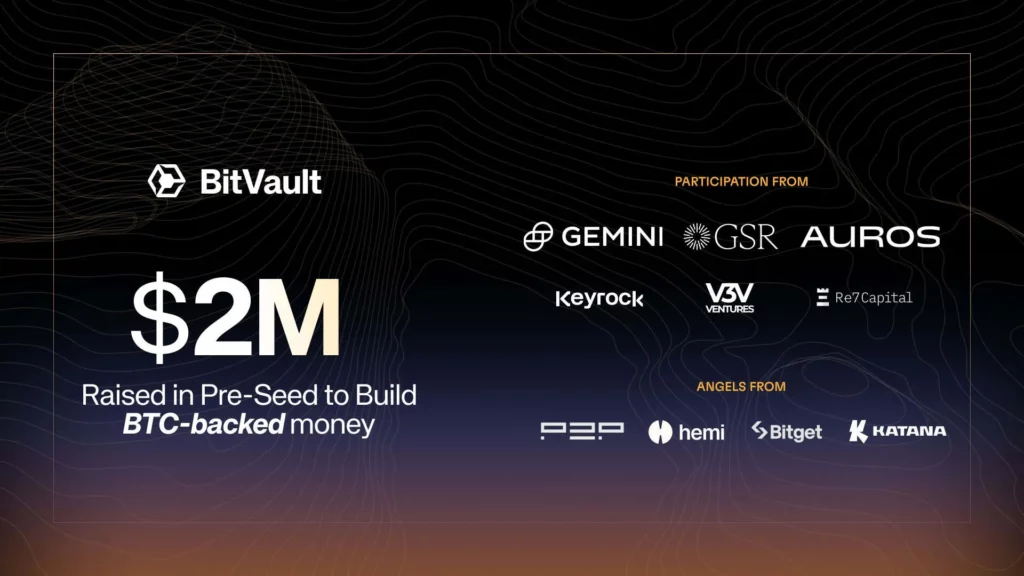

Bitcoin-backed stablecoin protocol BitVault has secured a significant $2 million pre-seed funding round from prominent investors GSR, Gemini, and Auros. The substantial influx of capital will be utilized to launch the protocol’s flagship product, a Bitcoin-backed money toggle known as bvUSD, which seeks to redefine Bitcoin’s role in stablecoin infrastructure.

According to reports, BitVault’s innovative approach focuses on providing an institutional-grade, capital-efficient solution for money through its BTC-backed stablecoin and yield-bearing staked stablecoin. These features include user-set interest rates, multi-collateral backing, and enhanced liquidity mechanisms.

The development of this new protocol has garnered attention from notable investors like GSR, Gemini, and Auros, who recognize the immense potential in redefining Bitcoin’s role in stablecoin infrastructure. The influx of funds will support the mainnet deployment on Katana, a DeFi-first chain incubated by Polygon Labs and GSR.

This strategic funding round is expected to bolster BitVault’s position as a central actor in the emerging liquidity and settlement network across the EVM chain. The company plans to extend its stablecoin suite to accommodate additional BTC-based collateral assets and will be actively onboarding institutional borrowers.

The protocol, built by a team of seasoned developers from VaultCraft, leverages Liquity V2’s licensed fork to provide an automated and governance-free mechanism for borrowing, while also featuring permissioned borrowing.

Source: cryptopotato.com