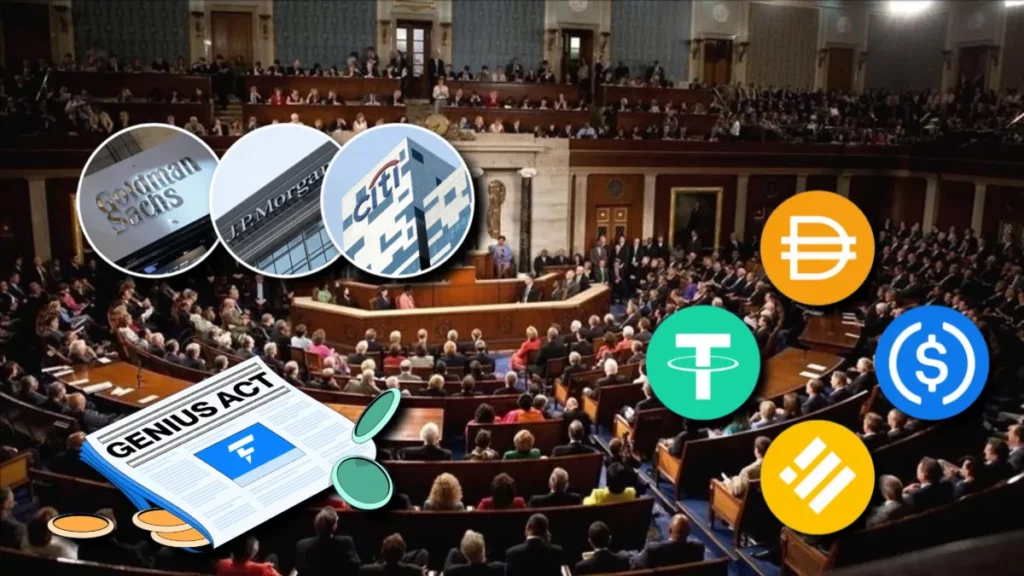

Banks are Afraid of Stablecoins: Groups Call for Tighter Rules Under GENIUS Act

A growing concern among financial institutions is the increasing popularity and potential implications of stablecoins, which has led several banking groups to urge lawmakers to address a perceived loophole in the GENIUS Act. The Bank Policy Institute (BPI) is spearheading this effort, warning that unregulated yield-bearing stablecoin practices could destabilize traditional banking.

The BPI’s concerns center around the ability of stablecoin issuers to offer yields indirectly through affiliated businesses or exchanges, potentially sidestepping restrictions designed to prevent competition with conventional banks. According to the organization, ignoring this issue may trigger a staggering $6.6 trillion in deposit outflows from traditional banks, putting pressure on credit availability for businesses and households while increasing systemic risk during times of financial stress.

Stablecoin yields have become a key draw for cryptocurrency users, fostering liquidity and driving adoption rates. By allowing investors to earn interest without the need for intermediaries, stablecoins are transforming the digital landscape. However, critics argue that these practices may be circumventing regulations meant to safeguard traditional banking institutions.

Despite the banking sector’s apprehension, proponents of decentralized finance (DeFi) emphasize that well-structured regulation would permit stablecoins to flourish while maintaining financial stability. With adoption rates on the rise and market capitalization nearing $280 billion, some experts argue that stifling innovation could harm the US dollar’s standing globally.

A crucial consideration is the growing potential of stablecoins in global financial systems. Experts suggest that these digital assets can create new investment opportunities, enhance payment systems, and improve access to digital financial services throughout the United States and beyond.

Source: crypto-economy.com