Odds of a December Fed rate cut collapse as markets reprice monetary policy

Investor expectations for a December Federal Reserve rate cut have collapsed following the latest Fed minutes signaling caution on inflation and uncertainty in the labor market, leading to a sharp repricing of monetary policy bets.

As it stands, real-money prediction markets now price in a significantly reduced chance of policy easing next month, prompting a notable shift across asset classes, with crypto experiencing the brunt of the impact.

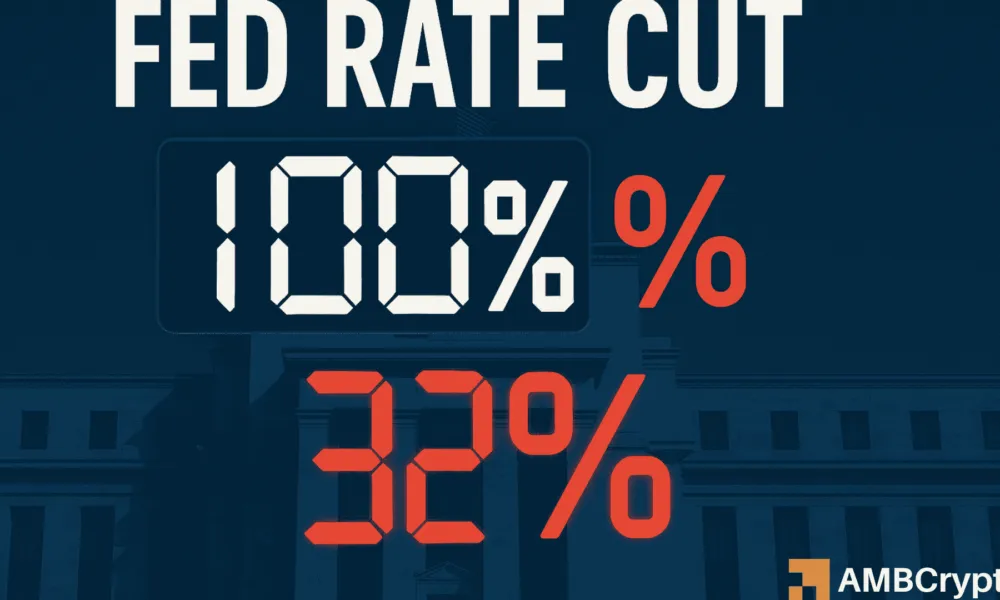

According to Polymarket traders, there is now only a 32% probability that the Fed will cut rates by 25bps in December, down from near-certainty just weeks ago. Conversely, odds of no change stand at an astonishing 67%. Larger cuts are considered highly improbable at just 2%, while hike odds register at a negligible 1%.

The swift reversal in rate expectations has directly influenced market behavior, with equities holding firm despite volatility, whereas crypto is continuing to unwind sharply as liquidity expectations wane.

Source: ambcrypto.com