Grayscale Bitcoin Mini Trust Surpasses $1 Billion in Net Inflows

The Grayscale Bitcoin Mini Trust has successfully surpassed the massive milestone of exceeding $1 billion in net inflows, as reported by the company on December 17. This significant accomplishment marks a substantial increase in investor interest and trust in low-cost cryptocurrency investment options.

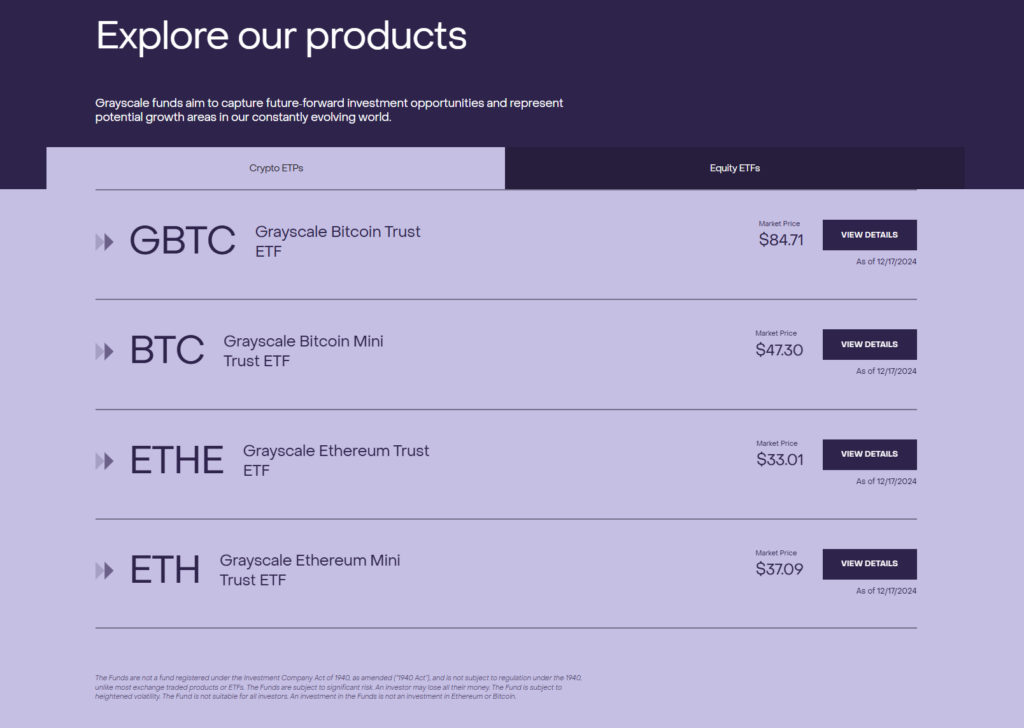

As part of its efforts to cater to this demand, Grayscale introduced the Bitcoin Mini Trust and Ethereum Mini Trust in July, offering alternative solutions to its higher-cost products, such as the Grayscale Bitcoin Trust (GBTC) and Ethereum Trust (ETHE). The Grayscale Bitcoin Mini Trust charges a remarkably low management fee of 0.15%, significantly lower than the 1.5% and 2.5% fees associated with GBTC and ETHE, respectively.

This adjustment aims to provide investors seeking affordable cryptocurrency ETFs with accessible investment opportunities. John Hoffman, Grayscale’s managing director, stated that the success of low-cost funds like BTC and ETH reflects a growing demand for accessible exchange-traded products (ETPs).

The launch of spot Bitcoin ETFs earlier in 2024 triggered significant activity in the crypto investment space. U.S.-based Bitcoin ETFs collectively crossed $100 billion in assets by November, according to Bloomberg Intelligence. Bitcoin ETFs Surpass U.S. Gold ETFs in AUM. Source: K33 Research

In response to this growing demand and competition within the market, many ETF providers have engaged in fee reductions to attract investors. As an example, VanEck extended its fee waiver for its VanEck Bitcoin ETF (HODL) in November. The typical fee for cryptocurrency ETFs ranges between 0.15% and 0.25% annually, with Grayscale’s Mini Trusts at the lower end of this spectrum.

Beyond its Bitcoin offerings, Grayscale has further expanded its investment fund portfolio by introducing funds for alternative cryptocurrencies. In October, the company launched an investment fund for Aave’s governance token , while in August, it introduced funds for tokens like Sky, Bittensor, and Sui. Additionally, Grayscale filed for SEC approval to list a new index ETF.

Source: coinchapter.com