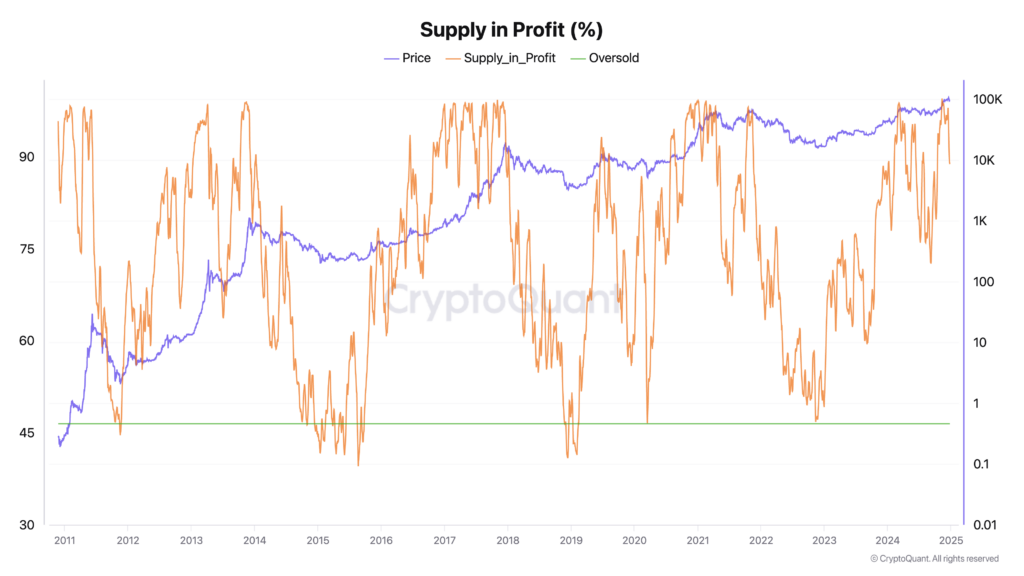

Title: Bitcoin’s Supply in Profit Drops to 88%

As the crypto market continues to grapple with volatility and uncertainty, a recent trend has caught the attention of analysts and investors alike. In a stark departure from previous patterns, Bitcoin’s supply in profit has plummeted to an unprecedented 88%. This staggering figure is a far cry from the usual thresholds seen in past bull cycles.

While some might view this development as a cause for concern, historical data suggests that such extreme levels of supply in profit have often preceded major market shifts and reversals. In other words, this anomaly could potentially signal a significant turning point for Bitcoin’s price trajectory.

Historically, high levels of supply in profit, exceeding 80%, have been seen as an indispensable part of previous bull cycles. This phenomenon has consistently served as a vital barometer of the overall health of the market, and we are witnessing an unprecedented drop to 88%. While it is natural for investors to become apprehensive about further price declines, it is essential to maintain perspective and consider the broader implications of this data.

As the market becomes increasingly uncertain, Bitcoin’s supply in profit serves as a vital indicator of sentiment and investment appetite. Any further insights or developments will be closely monitored, but for now, it seems that the narrative has shifted dramatically.

Andjela Radmilac is an analyst at CryptoSlate, where she covers the latest crypto trends, news, and market insights.

Source: cryptoslate.com