Markets Show Resilience Ahead of End-of-Year Options Expirations: Bybit x Block Scholes Crypto Derivatives Report

As the year comes to a close, financial markets have demonstrated an unexpected resilience in the face of impending end-of-year options expirations. According to a newly released report by Bybit and Block Scholes, this development may have significant implications for traders.

The study highlights that BTC’s realized volatility has increased in recent times, yet short-term options have failed to adjust accordingly. This disparity suggests that while spot prices are experiencing fluctuations, the options market is not fully reflecting these changes.

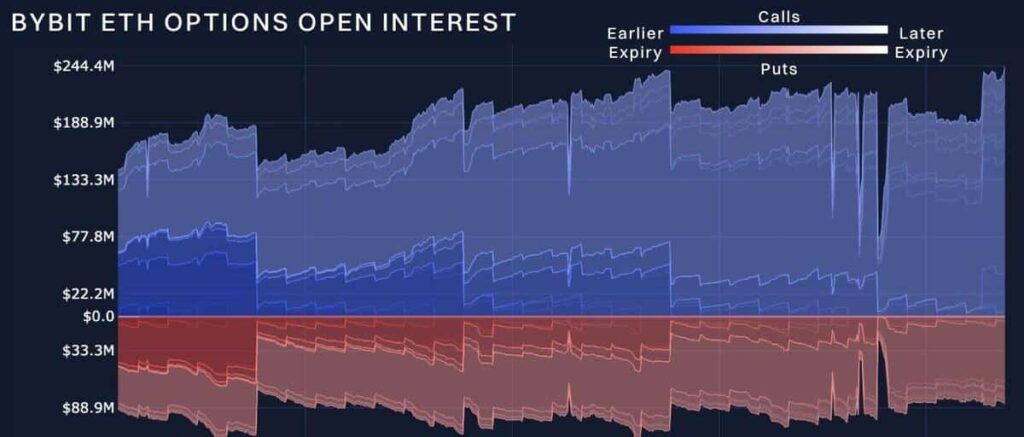

One notable aspect of this report is the unusual inversion observed in ETH’s volatility structure. In contrast, BTC has not mirrored this reaction. Moreover, a shift in funding rates, which occasionally turn negative as spot prices drop, signals a new phase for the markets.

The data underscores that open interest in BTC options remains at an elevated level, potentially contributing to increased volatility as year-end approaches. Approximately $360 million worth of BTC options, comprising both put and call contracts, are set to expire shortly, posing potential risks to price movements.

On the other hand, ETH’s short-term options are exhibiting more pronounced fluctuations than previously seen. Despite a mid-week inversion in the report’s findings, ETH’s volatility term structure has since flattened, maintaining levels comparable to those witnessed throughout the past month.

The full report, available for download at Bybit.com, offers users and traders valuable insights and exploration of potential implications on their crypto trading strategies.

Bybit, being the world’s second-largest cryptocurrency exchange by trading volume, is known for its commitment to providing a secure platform and robust infrastructure.

Source: www.crypto-news.net