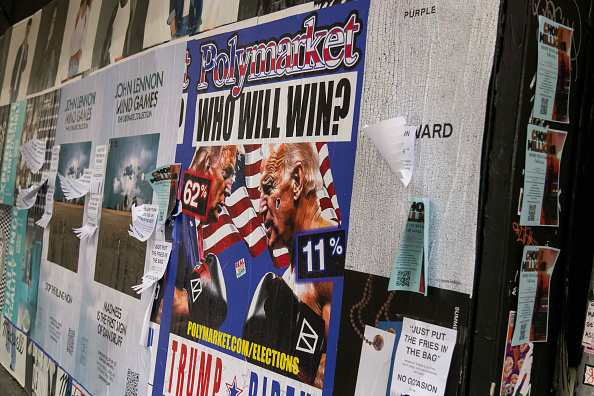

A Polymarket advertisement in the Brooklyn borough of New York, US, on Monday, July 22, 2024. Various US election outcomes have propelled open wagers close to $1 billion on Polymarket, a 500% jump over the past few months, even though Polymarket says it has excluded US users since 2022 as part of a settlement with federal regulators. Photographer: Michael Nagle/Bloomberg via Getty Images

Kalshi CEO Admits Enlisting Influencers to Discredit Polymarket in Now-Deleted Podcast Segment

In a recent podcast interview that has since been deleted, Kalshi’s CEO Tarek Mansour confirmed that his employees did approach social media influencers to promote memes about the FBI’s raid on the home of his arch-rival, Shayne Coplan, CEO at competing events-betting platform Polymarket.

According to reports, both companies offer a new type of betting industry where users wager on the outcomes of various events, ranging from elections to popular culture. The FBI recently conducted a raid on Polymarket’s CEO residence, reportedly due to political motivations surrounding wagers on the US presidential election.

Mansour’s comments came in response to allegations that Kalshi has been using its influence to discredit Polymarket. This latest development highlights the ongoing feud between the two companies, which have already clashed over regulatory issues and market share.

In September, TechCrunch reported that Kalshi won a lawsuit allowing it to accept bets on election outcomes. On the other hand, Polymarket faced legal restrictions due to a 2022 settlement with the Commodity Futures Trading Commission (CFTC) and the Securities and Exchange Commission (SEC).

The deleted podcast interview raises concerns about Mansour’s role in allegedly engaging influencers to spread negative sentiments about Polymarket. The move is seen as an attempt by Kalshi to gain an upper hand in a highly competitive market, where both companies are vying for dominance.

As previously reported, Sequoia and Y Combinator back Kalshi, which is currently in the process of raising a funding round exceeding $50 million.

Source: techcrunch.com