Title: Global Transaction Tax Software: Trillion-Dollar Stakes

The trillion-dollar stakes of global transaction tax software have reached a boiling point. The rise of AI-powered sales and services has brought about unprecedented complexity in VAT and GST enforcement, leaving startups and scale-ups scrambling to keep up with the sheer volume and evolving regulatory landscape. Amidst this chaos, one startup, Taxwire, is emerging as a game-changer.

Tax compliance has always been a necessary evil for businesses, but the proliferation of AI-driven commerce has magnified the issue exponentially. The stakes are no longer trivial: noncompliance can result in crippling fines, reputational damage, and even business closures. For early-stage companies, tax compliance is now an existential risk that threatens to upend their entire operations.

The Current Reality

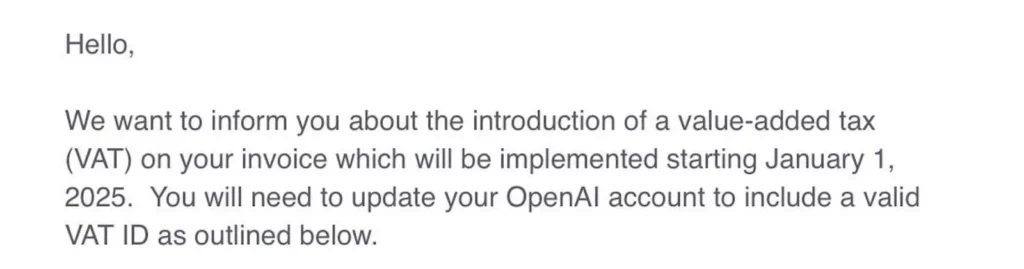

In today’s environment, AI-driven businesses face unprecedented challenges. With the rise of e-commerce, cross-border transactions have become ubiquitous. However, VAT and GST enforcement has been slow to adapt to this new reality, creating a regulatory gap that puts entrepreneurs at risk. This gap is not limited to traditional e-commerce; it encompasses an ever-expanding array of services, including software-as-a-service (SaaS), digital goods, and even creative industries.

The AI Revolution Has Changed Everything

In the past, tax compliance was relegated to the backburner as companies focused on product development and growth. However, with AI’s explosive adoption, this complacency is no longer tenable. Businesses are now forced to confront the complexities of global tax laws head-on, or risk facing crippling consequences.

Enter Taxwire: A Revolution in Global Transaction Tax Software

Taxwire CEO Andrew Rea believes that traditional sales tax software solutions have failed to keep pace with the AI-driven revolution. “No one else was building the right product, the right way,” he argues. This startup is poised to change the status quo by addressing the specific pain points of AI-powered businesses.

Rea’s vision for Taxwire revolves around end-to-end global transaction tax software that automates historical non-compliance audits, ongoing calculations, filings, and remittances with precision. Unlike traditional solutions, this approach aims to avoid incremental costs associated with compute usage, dynamic pricing, and licensing fees from providers like OpenAI or Anthropic.

This is not a trivial matter. The stakes are no longer just about avoiding fines; they’re now about survival in an increasingly competitive landscape. With the global transaction tax software market projected to reach trillions of dollars in value by 2025, companies that fail to adapt will struggle to keep up with the pace of innovation.

The Emergence of Modern Solutions

This wave of modern solutions is characterized by a shift away from traditional sales tax software. We’re witnessing the rise of AI-driven tax compliance platforms like Taxwire that tackle the unique challenges posed by generative AI, digital goods, and services. It’s crucial to recognize that the old guard has given way to new entrants.

In this era, startup CFOs and controllers must rethink their basis-point models. No longer can they rely on outdated pricing structures or traditional software solutions. Taxwire CEO Andrew Rea stresses, “Neglecting tax compliance is like deferring treatment for an infection—the problem grows, and consequences eventually demand action.”

Taxwire’s Approach

Graham Martin, head of tax at Taxwire, emphasizes the importance of a niche strategy: “Vendor choice depends on industry, activities, risk tolerance, and resources.” By catering to high-growth companies, particularly those in AI-powered sectors, Taxwire aims to offer scalable pricing that aligns with the realities of these businesses.

The Future of Global Transaction Tax Software

The landscape is shifting dramatically. Startups and scale-ups are no longer willing to tolerate costly, manual compliance processes or outdated software solutions. The Trillion-Dollar Stakes: Why Global Transaction Tax Software Matters Now more than ever, entrepreneurs must prioritize tax compliance as a critical component of their financial health.

Source: https://www.forbes.com/sites/davidmoon/2025/03/26/global-transaction-tax-software-trillion-dollar-stakes/