Ethereum vs Bitcoin: Why ETH Is Underperforming Amid Market Turmoil

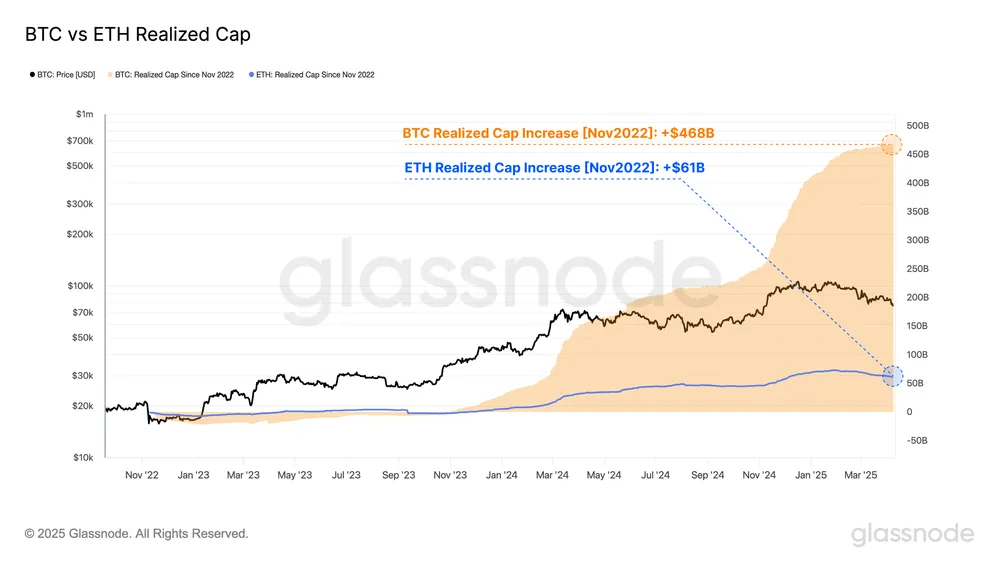

The cryptocurrency market has been witnessing a tumultuous period, with investors experiencing significant losses. In this scenario, it’s not surprising to see one of the top cryptocurrencies, Ethereum, underperforming compared to Bitcoin. According to recent data, Ethereum’s realised cap grew by only 32% since late 2022, whereas Bitcoin’s realised cap surged by at least 117% during the same period.

This disparity highlights a concerning trend for Ethereum investors: the cryptocurrency is not generating enough demand or adoption growth. The chart also shows that average holders of ETH are now at a loss, whereas Bitcoin owners still have paper profits. This could lead to increased selling pressure in the Ethereum market.

In addition to this underperformance, it’s worth noting that Bitcoin has been consistently outperforming Ethereum for an extended period of over 800 days. Furthermore, since September 2022, the ETH/BTC pair has plummeted by at least 75%. These figures demonstrate a severe divergence between the two cryptocurrencies.

One possible explanation for this disparity could be the lack of strong bullish momentum that Ethereum experienced in previous bull markets. Instead, it’s Bitcoin that continues to dominate and receive most of the attention from investors.

In conclusion, the data suggests that Ethereum is unlikely to recover its momentum unless significant support arrives in the form of a strong market rally or fresh adoption.

Source: https://coinpedia.org/news/ethereum-vs-bitcoin-why-eth-is-underperforming-amid-market-turmoil/