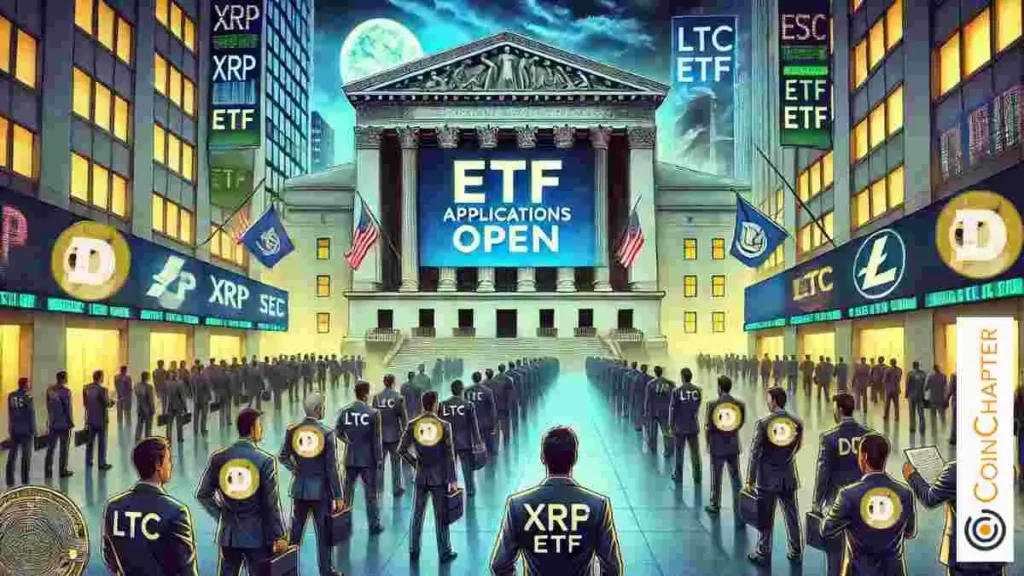

SEC Takes First Step on Grayscale’s XRP and DOGE ETF Filings—Decision Expected in October

The US Securities and Exchange Commission (SEC) has taken the first step by acknowledging Grayscale’s applications for spot XRP ETF and Dogecoin (DOGE) ETF. The filing, confirmed on February 13, moves the Grayscale XRP Trust and Grayscale Dogecoin Trust into the official review process.

This development means that the SEC’s 240-day review period will begin once the filings are published in the federal register. This process typically takes a few days. If registered soon, the SEC’s decision on the XRP ETF and DOGE ETF would be expected by mid-October.

The acknowledgment comes as the regulatory body has recently reviewed multiple crypto ETF applications, including Litecoin (LTC) and Solana (SOL). Analysts have assessed the chances of approval for these ETFs. Bloomberg ETF analysts James Seyffart and Eric Balchunas estimate a 65% probability of XRP ETF approval by 2025 and a 75% probability for Dogecoin ETF approval.

In contrast, they anticipate a 90% chance for Litecoin ETF approval before the end of 2025. The potential approval of these ETFs could significantly impact the future of crypto investment products in the US.

It is worth noting that Grayscale’s XRP ETF faces legal challenges from Ripple Labs due to an ongoing SEC case against the company. A court ruling in August 2023 stated that XRP is not a security when sold on secondary markets, but the SEC appealed, arguing that Ripple Labs violated securities laws when selling XRP to retail investors.

The outcome of this lawsuit may have implications for the SEC’s decision regarding Grayscale’s XRP ETF application. On the other hand, Dogecoin (DOGE) has not been classified as a security by the regulator and does not face similar legal hurdles.

As a decentralized digital currency, DOGE operates similarly to Bitcoin, which has already received SEC ETF approvals. The lack of classification as a security combined with its decentralized nature might provide a clearer path for approval.

The potential outcome of these ETF applications will set a significant precedent for crypto investment products in the US market.

Source: coinchapter.com