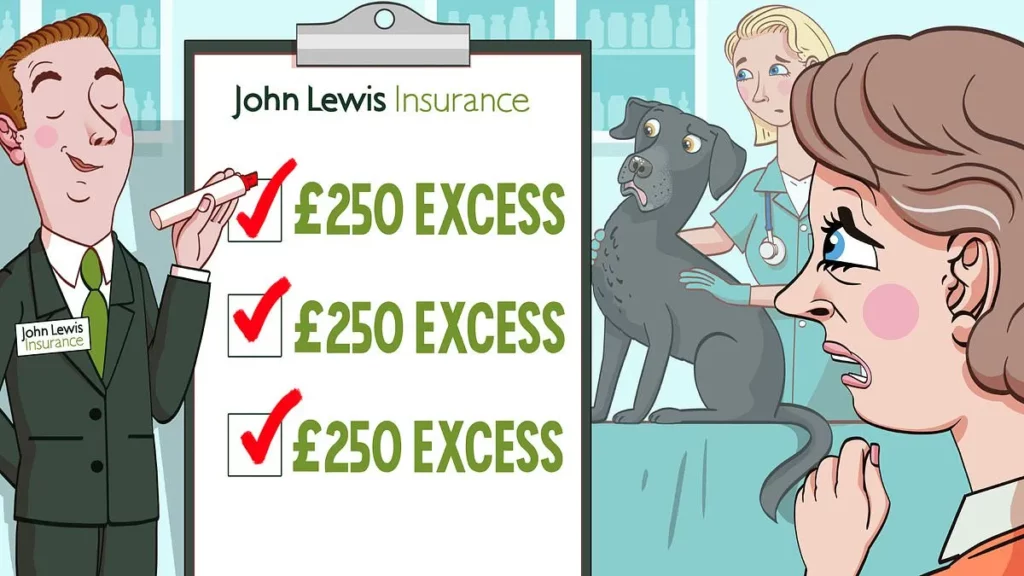

Pet Insurer Charged £250 Excess Three Times After Our Black Labrador’s Single Operation: Sally Sorts It

As a pet owner, it can be devastating to have your furry friend undergo an operation. The financial burden that comes with such expenses is not only stressful but also overwhelming. Unfortunately, a reader from Essex recently experienced this and was slapped with an unnecessary £750 excess by their insurer.

The reader, who wishes to remain anonymous, shared their story with me. Their beloved black labrador retriever, Vicki, required surgery due to the presence of multiple skin tumours. While the operation was successful, the pet insurance company, John Lewis (underwritten by Royal & Sun Alliance), took a massive £250 excess THREE TIMES for this single procedure.

As I dug deeper into this case, it became clear that there were actually four different types of lumps removed during the surgery. According to the policy, an excess must be paid for each accident or illness. However, one would reasonably expect that a single operation would only trigger one excess payment, not three. It seems that John Lewis’ approach is not unique in this industry.

In fact, I discovered that several brokers have a ‘common approach’ of charging separate excesses for multiple conditions or illnesses. However, it’s crucial to carefully review the policy terms and understand what you are agreeing to when purchasing pet insurance. One broker I spoke with even suggested that sometimes, tumours, regardless of their type, can be treated as one condition.

Unfortunately, this was not the case here. John Lewis stuck by their initial assessment, citing the ‘common approach’ in the industry. As a result, the reader had to foot an additional £750 for a single operation.

This situation highlights the importance of thoroughly reading and understanding the policy terms before signing up with a provider. It is crucial to know what you are getting yourself into and avoid any potential pitfalls.

In conclusion, it’s vital to carefully review your pet insurance policy to ensure that you’re not caught off guard by unexpected costs.

Source: www.dailymail.co.uk