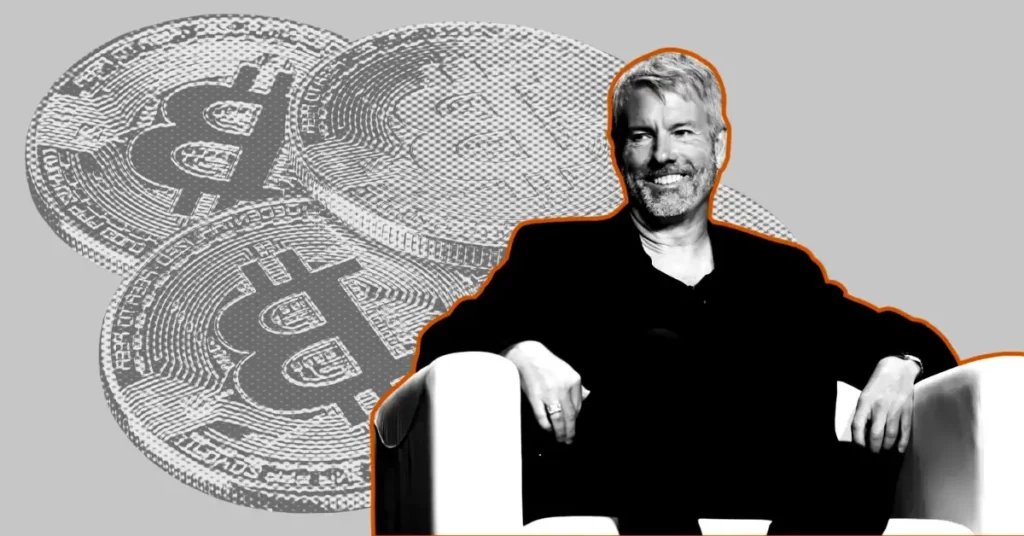

MSTR Plummets 55%; MicroStrategy’s $43.7 Billion in Bitcoin at Risk of Being Sold?

The once-dominant tech giant, formerly known as MicroStrategy, has found itself in a precarious financial situation after its stock plummeted by an astonishing 55% since the start of the year. This drastic drop has sparked widespread concerns that the company may be forced to sell off its massive Bitcoin holdings to stay afloat.

As it stands, MicroStrategy holds a staggering 499,096 BTC, valued at an eye-watering $43.7 billion, with an average purchase price of $66,350 per coin. If the value of Bitcoin were to drop below this average, the company may be compelled to sell some or all of its holdings to cover its debt.

However, a recent analysis from The Kobeissi Letter suggests that such a scenario is highly unlikely. MicroStrategy’s strategy, which involves borrowing money with low-interest notes, purchasing Bitcoin to push up its value, selling shares, and then buying more Bitcoin, reduces the risk of a massive sell-off.

Source: https://coinpedia.org/news/mstr-plummets-55-43-7b-bitcoin-to-face-sell-off-risk/