DeFi’s Next Chapter: Decentralization May Surpass Speed

The latest development in the decentralized finance (DeFi) ecosystem has sparked a heated debate on the direction of its future trajectory. In this era, when mainstream finance is finally taking notice of blockchain-based innovations, it is crucial to decide what kind of infrastructure we want to build for the future of finance.

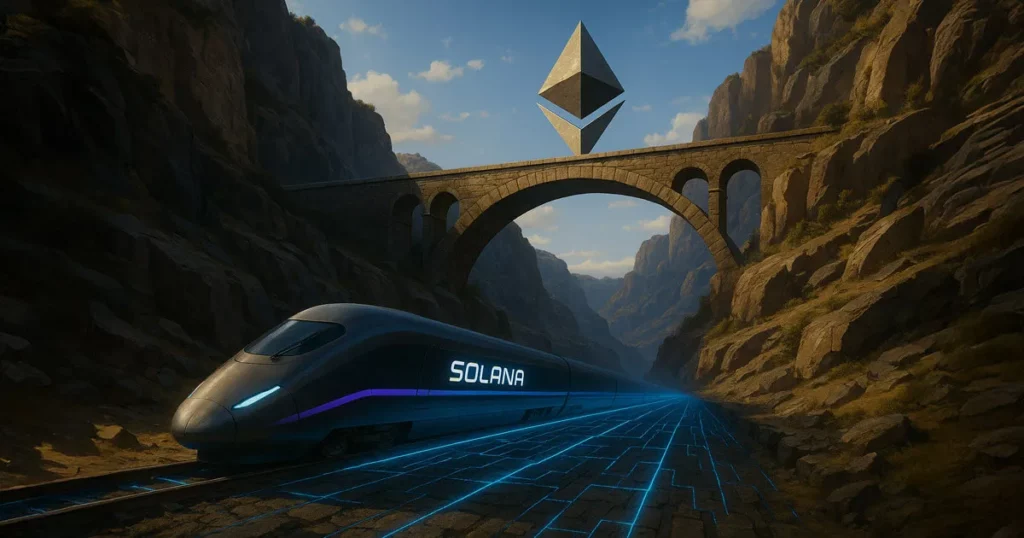

In essence, two contrasting visions are vying for supremacy: Ethereum’s secure and decentralized architecture versus Solana’s lightning-fast transactions. At first glance, this dichotomy may seem like a straightforward choice between speed and security. However, as I will argue below, decentralization might surpass speed in DeFi’s next chapter.

Ethereum: The Decentralized Foundation

It is essential to emphasize that Ethereum is more than just a blockchain – it serves as the foundation of modern DeFi. This is where secure, composable applications can thrive and long-term financial infrastructure is being built. Institutional players seek Ethereum when they want to tokenize assets with confidence, and capital flows here for security.

The fact that over 55% of the total value locked (TVL) across major chains resides on Ethereum speaks volumes about its dominance in this space. Unlike Solana’s one-size-fits-all Layer 1, Ethereum has embraced a modular scaling approach. This design preserves decentralization while enabling scale.

With the rollout of Proto-Danksharding in early 2025, Layer 2 transaction costs have dropped significantly – cementing Ethereum’s lead in modular architecture. That said, Ethereum’s model has trade-offs. Its reliance on Layer 2s can introduce fragmentation. Some DeFi primitives need to reside on Layer 1 for full composability.

On the other hand, I believe it is vital to recognize that these compromises are more than worthwhile when security and decentralization are considered paramount. In this era of increasing regulatory scrutiny, Ethereum’s political neutrality is a key trait in an ever-regulated environment. Speed and user experience can be optimized over time but decentralization cannot.

Ethereum developer experience is another significant advantage. Writing smart contracts on Ethereum becomes significantly simpler than on Solana, allowing developers to create secure, well-tested code. This maturity partly explains why nearly every major DeFi innovation originated on Ethereum.

In contrast, when security and composability align, the entire ecosystem benefits, which has led to its overwhelming presence in this space.

Solana: Fast but Centralized

On the other hand, Solana addresses the same scaling challenge from a different angle. Its monolithic architecture keeps everything on a single Layer 1, offering tangible benefits – fast transactions and low fees.

In terms of raw performance, Solana is compelling – capable of processing 3,000-4,000 transactions per second (TPS) today with expectations to reach over 1 million TPS through the upcoming Firedancer validator.

However, this impressive speed comes at a cost. The network includes a leader node that sequences transactions, which while improving throughput introduces centralization risks and compromises on true decentralization.

A critical distinction is made between distributed networks and truly decentralized ones. We will explore how each of these options has its place within DeFi, but for now, it suffices to note the importance of this distinction in today’s regulated environment.

As I delve into the core debate in 2025—and beyond—centered on what we should prioritize: structural integrity or mass adoption?

Source: cryptoslate.com