Qatar’s JTA May Invest $1 Billion In Vietnam’s Top Tycoon’s VinFast

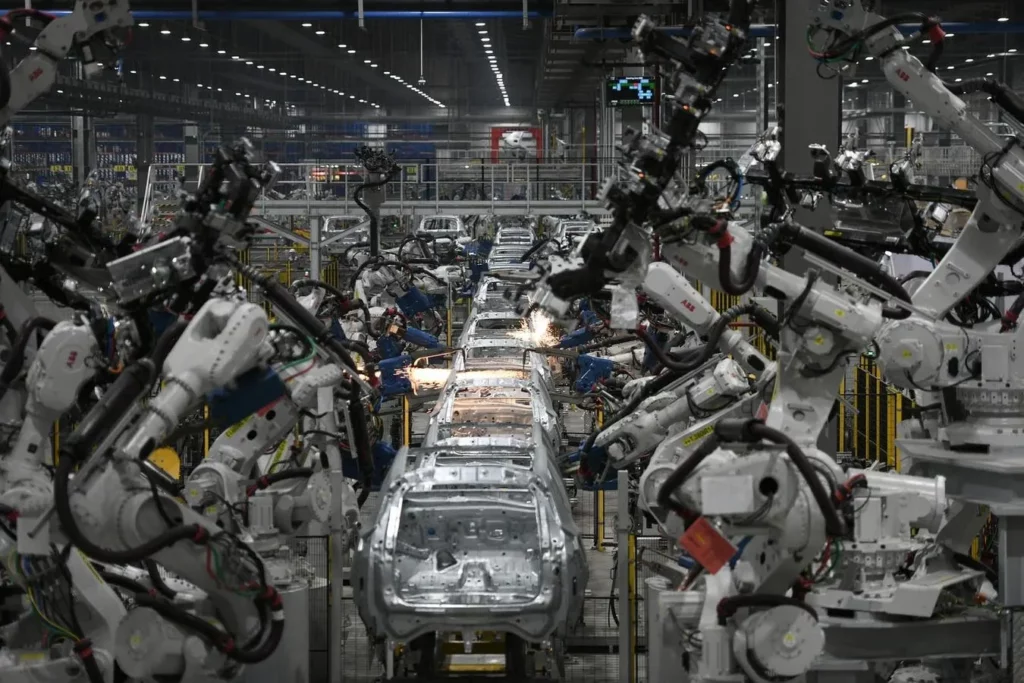

In a significant move, Qatar-based investment firm JTA Investment Qatar is reportedly in talks with Vietnamese conglomerate Vingroup to invest at least $1 billion in its unprofitable electric vehicle (EV) arm, VinFast. The potential partnership comes as VinFast’s parent company, Vingroup, seeks to strengthen its financial footing amid concerns over the company’s ability to sustain its operations.

Under a memorandum of understanding signed recently, JTA Investment Qatar is exploring possible investments in assets owned by Vinpearl, Vingroup’s hospitality arm. While details remain scarce, industry insiders suggest that this collaboration could unlock significant opportunities for Vingroup and its subsidiaries to drive technological advancements, infrastructure development, and sustainable economic growth in Vietnam.

The potential investment comes as a relief to Pham Nhat Vuong, Vietnam’s richest man with an estimated net worth of $5.3 billion, who has committed to investing $2 billion to rescue VinFast from financial difficulties. The company’s stock listed on the Nasdaq in August 2023, with a market capitalization of $8.46 billion.

JTA Investment Qatar’s involvement could also facilitate VinFast’s global expansion and technology enhancements. The Qatari firm has built a presence in several international markets, including the United Kingdom.

In a statement, Vingroup Vice Chairwoman Le Thi Thu Thuy emphasized that this partnership will enable successful projects that promote sustainable progress, technological innovation in key sectors like electric vehicles and tourism, and strategic expansion into high-growth markets.

The proposed investment also has significant implications for Vietnam’s economic landscape. VinFast, which listed on the Nasdaq in August 2023, is poised to become a major player in the global EV market. The partnership with JTA Investment Qatar could accelerate this growth, fostering job creation and driving economic development in the region.

As part of the proposed deal, JTA Investment Qatar may also explore investments in Vinpearl’s five-star hotels, resorts, amusement parks, and other hospitality assets. Vingroup has been actively considering joint ventures to expand and enhance Vinpearl’s property developments, focusing on high-growth tourism markets.

In a statement, Dr. Amir Ali Salemi, founder and CEO of JTA Investment Qatar, expressed enthusiasm about the proposed collaboration, stating that it will generate mutually beneficial business opportunities and facilitate Vingroup’s strategic expansion into international markets.

Pham Nhat Vuong’s rise to prominence began with his instant noodle business in Ukraine, which he sold to Nestle in 2010. He used the proceeds to establish Vingroup, now a conglomerate with interests in real estate, retail, healthcare, education, autos, and technology.

Vingroup has made significant strides since its inception, growing into Vietnam’s largest private company.