Title: 4 Strong Signs Say Bitcoin To See Massive Rally In October

Bitcoin’s price has taken a slight dip after the Fed decided not to cut interest rates, but investors should not be fooled. Underlying indicators suggest that the cryptocurrency is about to make a significant surge in October.

Firstly, historical patterns and cycles are indicating a strong bullish period for Bitcoin in the coming months. The 4-year cycle, specifically, suggests that we may see a major top around October 20th, 2025. Furthermore, it’s worth noting that Bitcoin has historically performed well during this month, boasting an impressive average gain of 21.9% over the past 12 years.

Secondly, global liquidity metrics are also hinting at a rally in the near future. The M2 money supply is expected to peak on September 23rd, which could lead to a surge in Bitcoin’s value before this metric does. In previous cycles, Bitcoin has typically topped before M2 reaches its peak, making October an attractive investment opportunity.

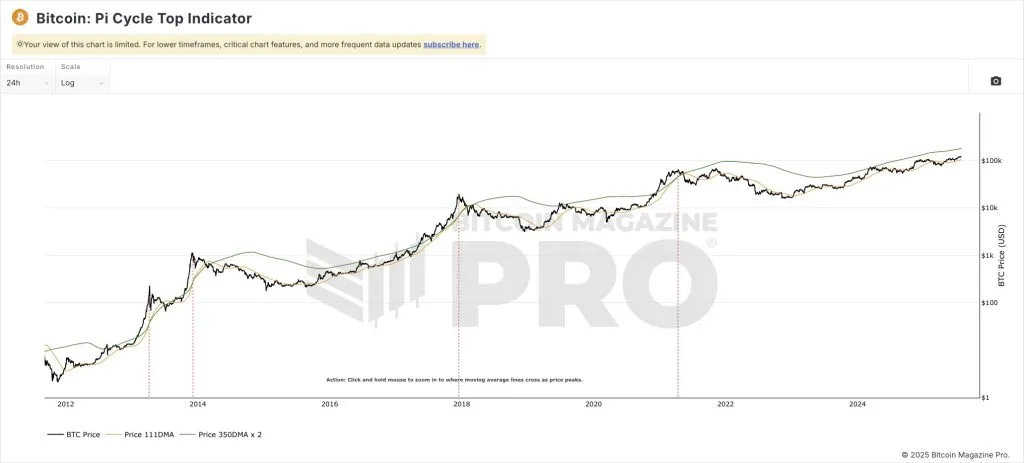

Thirdly, the Pi Cycle Top Indicator, a popular chart-based tool, is signaling the possibility of a top price zone emerging. This indicator has successfully predicted key price levels in past cycles and is currently suggesting that Bitcoin’s momentum is building towards a significant increase.

Lastly, investors are noticing a shift away from altcoins to Bitcoin, which could be a precursor to a massive rally. In previous cycles, we’ve seen a rotation into the top-performing cryptocurrency as investors rush to capitalize on potential gains. This sentiment mirrors earlier cycles where investor fear and panic selling around altcoins led to a surge in Bitcoin’s value.

Given these indicators and patterns, it is possible that Bitcoin may see significant gains in October. Some analysts believe that prices could even reach $130K or higher, although this remains speculative.

Source: coinpedia.org